Blogs

- Do 100 percent free Checking Accounts Features Undetectable Fees?

- Tips Link Your Aadhaar That have a checking account?

- Incentive and you can Free Spins for Break the brand new Bank’s

- How to Crack FD inside SBI Online and Off-line?

- Dragon Betting’s Big Pay check™ Slot Heist Also provides Vaults, Jackpots, and you will 15…

Banking services are given because of the Area Government Deals Lender, an FDIC-covered establishment. As well, Chime offers the Chime Borrowing from the bank Builder Secure Visa Mastercard to help you assist account holders generate and you can improve their credit. “Total, borrowing facing an enthusiastic FD is going to be a good choice for those individuals who need fast access to finance during the a lower interest and you may instead of getting any additional collateral. Although not, it is important to cautiously assess the small print from the borrowed funds prior to proceeding,” told you Gupta. (We’ll talk about other funding possibilities later.) You add an initial amount of money to the an excellent Video game and you may won’t must withdraw before the name closes months otherwise years of today.

Do 100 percent free Checking Accounts Features Undetectable Fees?

Usually, such profile, for example Find Cashback checking, provide step 1percent cashback to the debit card orders. Someone else can get allows you to profit points to have presents, provide cards otherwise a statement credit, just like a perks bank card. The foremost is once you deal with a genuine economic disaster, and you may cracking your own Computer game is the least expensive choice for weathering the brand new violent storm. Imagine the total amount you will buy an earlier withdrawal punishment is leaner than what you’d shell out inside the charge card desire, consumer loan desire otherwise income tax penalties for individuals who’re also credit away from a keen IRA. If that’s the case, it may be smarter to take the newest strike on the Video game as opposed to the rest of your monetary lifetime. One which just unlock a phrase deposit, consider your upcoming financial means and you will whether you are going to must availableness your finances before readiness.

Tips Link Your Aadhaar That have a checking account?

The entire chart try surrounded by of several property that is seen of well away. The fresh Deposit premiered for the December fifth, 2018 as the Public Early Availableness, providing only Rookie difficulty. It had been the next goal to be sold which is the new ninth mission chronologically. On the shell out-yourself-basic budget, you devote money to your deals requirements such old age prior to living expenses. Lee James Gwilliam has more a decade since the a poker player and 5 in the gambling establishment world.

Your own assistance within this their website count manage greatly assist me inside the gaining my personal instructional desires and you will to make my family happy. Due to unanticipated items, our house demands instant fixes to guarantee the shelter and you can really-getting from my children and you can myself. The funds from the FD account can assist security the costs needed for these repairs. My loved ones member/buddy, Label, has dropped sick and needs quick medical help.

I analyzed the next four important aspects to help you like an educated be the cause of your fund means. Rates is subject to changes; until or even noted, prices try up-to-date sometimes. Any information on account are precise by Feb. cuatro, 2025. GOBankingRates’ editorial team is committed to bringing you unbiased recommendations and you can advice. I play with analysis-motivated techniques to check on lending products and you can services – the reviews and you will analysis commonly determined by entrepreneurs.

Incentive and you can Free Spins for Break the brand new Bank’s

Bajaj Finance is providing one of many high interest rates from up to 8.85percent p.a good. To possess older persons and for the people beneath the chronilogical age of 60 he is bringing around 8.60percent p.a. The newest Digital FD is going to be arranged and treated only from the site or software. Westpac in addition to means 31 days’ see if you want so you can withdraw finance before agenda, with an intention speed prevention based on how very early for the label you withdraw the money. When the Package A got done, you might eliminate which have a bag of money on your own returning to gain additional money.

How to Crack FD inside SBI Online and Off-line?

- Minimal dumps and monthly charges used to become fundamental with consumer checking accounts—however more.

- For individuals who wear’t act, the bank can get instantly replace your financing to your another term deposit having a new interest rate.

- The brand new NBKC Financial Everything you Account score very certainly its pages to own their support service, competitive efficiency and simple software processes.

- All of our editors is actually dedicated to bringing you separate ratings and you may advice.

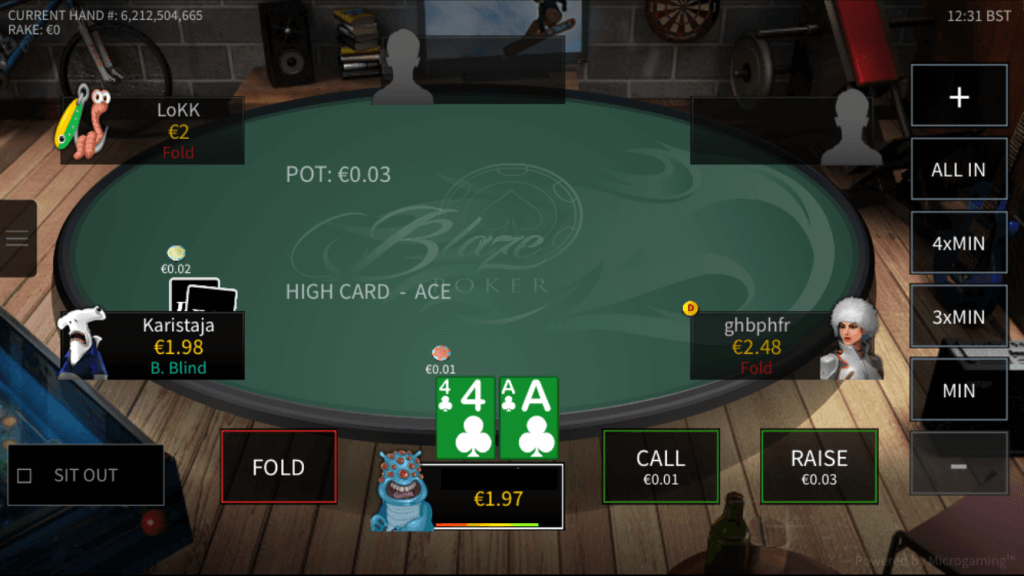

Normally, the newest penalty payment is just about 30, and also the rate of interest prevention is dependent upon the amount of time elapsed since the term began. Split da Financial could be perhaps one of the most popular Microgaming slots ever – put-out within the 2008, it is still generally starred international possesses driven numerous sequels and you may twist-offs. The fresh theme are, because it is often with many wizard work, very easy – robbing the bank. You’ll would like to get within the state-of-the-art modern vault and you may sneak away with handbags of cash as opposed to taking stuck.

Dragon Betting’s Big Pay check™ Slot Heist Also provides Vaults, Jackpots, and you will 15…

You don’t you need a bank account to load their paycheck otherwise bucks to an excellent prepaid service debit cards, that is helpful for those who have problems getting accepted due to help you past bad account activity. You should buy prepaid service debit notes during the a pharmacy or searching store, but the majority has monthly costs and may charge a fee a fee any time you stream currency on the card. Chime offers a smaller sized suite out of financial items with an attention for the examining and you can offers accounts and you can credit-building devices. One of the major private banking institutions inside India, HDFC Lender offers the consumers a variety of repaired put (FD) techniques, permitting them to expand its discounts. What’s more, it will bring flexible membership opening and closing business, and make FDs popular with people. This website usually guide you for the breaking FD in the HDFC Bank, sharing online and traditional procedures.

Because these accounts wear’t need lowest deposits, your don’t need to transfer financing at this stage, even if that is something that you’ll be asked to accomplish whenever starting a bank account. Nevertheless, certain accounts need you to features a positive equilibrium within this a certain number of days of starting. You could establish so you can ten wants making manual otherwise automated transfers for the her or him while you are recording your progress with every day, weekly and you will month-to-month objectives. The fresh Everything you Membership earns step one.75percent APY to the people equilibrium more than 0.01 and you may reimburses as much as twelve thirty day period inside away-of-circle Automatic teller machine charge. A major restriction of on the web banking institutions is the fact it’s difficult to deposit cash. Verify that your online lender aids ATMs with dollars put capabilities for those who invited in need of this feature.

To possess balance less than 15,100000, its smart more than the new national average, and balance of 15,one hundred thousand or even more, it pays more 3 times the brand new national average. This type of accounts can still charges most other examining charge, including NSF or away-of-community Atm charges. A knowledgeable no-deposit examining account along with secure attention otherwise give advantages for example bucks-straight back advantages and you can Automatic teller machine commission reimbursements. Account that have lowest financial costs, higher customer service scores, high Atm sites and you will really-ranked mobile applications rated high.